I have allways known that their is some surcharge around the 50 lac mark that impacts how much tax you pay as your income exceeds 50 lacs, 1 crore and so on. Below are the slabs.

Income Range | > Rs.50 lakh | > Rs.1 crore | > Rs.2 crore | > Rs.5 crore |

Surcharge Rate | 10% | 15% | 25% | 37% |

However this would imply that a person earning 50,00,000 would pay additional 10% tax compared o the person earning 49,99,999, this is unfair and hence the provision of a marginal relief on the surcharge payable kicks in as follows (Explained below)

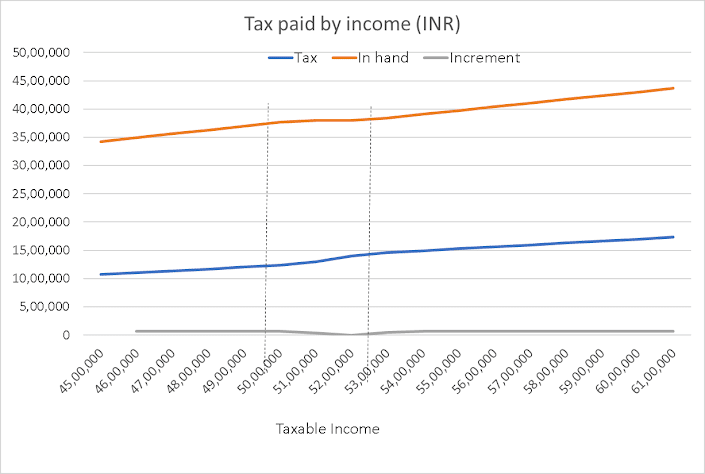

Below i have computed the actual tax payable and in hand income after tax.

Notice, there is a dead zone from 50 to 53 lacs where increase in salary is not leading to any increase in in-hand income due to surcharge kicking in

According to the Income-tax provisions, a marginal relief will be provided to certain taxpayers up to the amount of the difference between the excess tax payable (including surcharge) on the income above Rs.50 lakhs and the amount of income that exceeds Rs.50 Lakhs.

Suppose, an individual has a total income of Rs.51 Lakhs in a FY 2022-23.

- He will have to pay taxes inclusive of a surcharge of 10% on the tax computed i.e., total tax payable will be Rs. 14,76, 750.

- But, if he would have earned only Rs.50 lakhs, then the tax liability would have been Rs.13,12,500 only(excluding cess).

- Isn’t it unfair for the individual? For earning an extra Rs.1,00,000, he will end up paying income tax of Rs.1,64,250. The individual’s tax liability should be reduced to avoid any such excess tax payable.

- The individual will get a marginal relief of the difference amount between the excess tax payable on higher income i.e (Rs.14,76, 750 minus Rs.13,12,500 = Rs.1,64,250 ) and the amount of income that exceeds Rs. 50 Lakhs i.e. (Rs.51,00,000 minus Rs.50,00,000 = Rs.1,00,000).

- The marginal relief will be Rs.64,250 (Rs.1,64,250 minus Rs.1,00,000).

- Hence, income tax liability on income of Rs. 51,00,000 will be Rs.14,12,500 (excluding cess)